Cold vs Hot Wallets - Which Crypto Storage is Better?

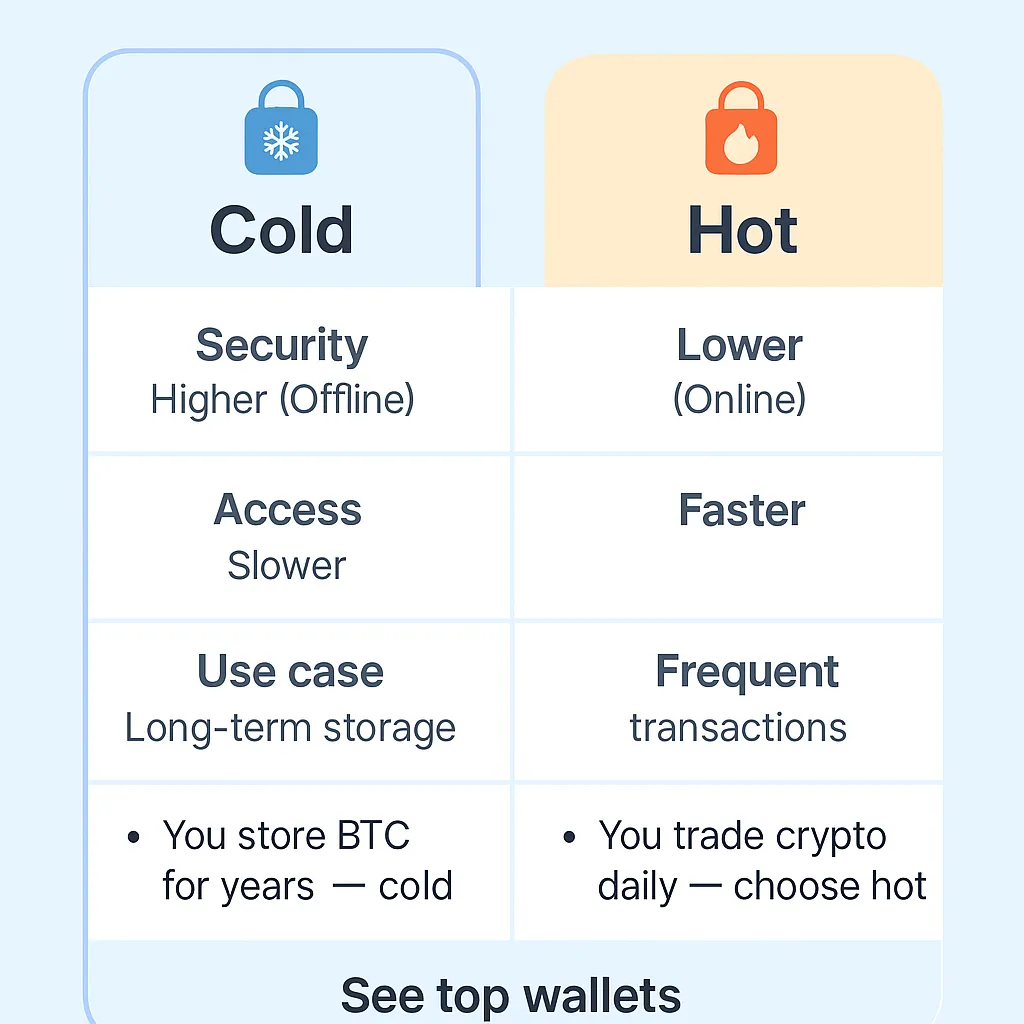

Choosing between cold and hot wallets is one of the most important decisions in cryptocurrency security. This comprehensive guide explains the fundamental differences, security implications, and practical use cases to help you make the right choice for your crypto storage needs in 2025.

Understanding Wallet Types in 2025

The cryptocurrency wallet landscape has evolved significantly, but the fundamental distinction between cold (offline) and hot (online) storage remains crucial for security. With over $3 billion lost to crypto hacks in 2024, understanding proper storage methods is more important than ever.

Cold wallets, also known as hardware wallets or offline storage, keep your private keys completely disconnected from the internet. Hot wallets, including mobile apps and browser extensions, maintain internet connectivity for convenient access to decentralized applications and trading platforms.

The choice between cold and hot storage isn't binary – most experienced users employ a hybrid approach, using both types strategically based on their specific needs and risk tolerance.

Cold Wallets: Maximum Security Storage

What Are Cold Wallets?

Cold wallets are cryptocurrency storage devices that keep your private keys completely offline, isolated from internet-connected devices. They generate and store private keys in a secure environment that never touches the internet, making them virtually immune to online attacks.

Types of Cold Storage

Hardware Wallets

Physical devices specifically designed for cryptocurrency storage:

- Ledger Nano S Plus: Entry-level hardware wallet supporting 5,500+ cryptocurrencies

- Ledger Nano X: Premium model with Bluetooth connectivity and mobile app support

- Trezor Model One: Open-source hardware wallet with strong security features

- Trezor Model T: Advanced model with touchscreen and expanded cryptocurrency support

- Tangem Wallet: Card-based hardware wallet with NFC technology

Paper Wallets

Physical documents containing private keys and addresses:

- Generated offline using secure random number generators

- Printed on paper or engraved on metal for durability

- Completely immune to digital attacks

- Requires careful physical security and backup procedures

Cold Wallet Advantages

Maximum Security

Cold wallets provide the highest level of security available for cryptocurrency storage. Private keys never touch internet-connected devices, making them immune to:

- Malware and viruses

- Phishing attacks

- Remote hacking attempts

- Exchange hacks and platform failures

- SIM swapping and social engineering

Long-Term Storage

Ideal for "hodling" strategies where cryptocurrencies are held for extended periods without frequent transactions. Cold storage encourages disciplined investing by making impulsive trades more difficult.

Multi-Signature Support

Many hardware wallets support multi-signature setups, requiring multiple devices or parties to authorise transactions, further enhancing security for large holdings.

Recovery Options

Hardware wallets use standardised recovery phrases (BIP39) that can restore access to funds even if the device is lost or damaged.

Cold Wallet Disadvantages

Inconvenience

Every transaction requires physical access to the device and manual confirmation, making frequent trading or DeFi interactions cumbersome.

Initial Cost

Hardware wallets require upfront investment ($50-200), though this cost is minimal compared to the security benefits for significant holdings.

Physical Risks

Devices can be lost, stolen, or damaged. While funds remain recoverable through seed phrases, physical security becomes crucial.

Technical Complexity

Setting up and using cold wallets requires more technical knowledge than hot wallets, potentially intimidating new users.

Hot Wallets: Convenience and Accessibility

What Are Hot Wallets?

Hot wallets are cryptocurrency storage applications that maintain internet connectivity, allowing instant access to funds and seamless interaction with blockchain networks and decentralized applications.

Types of Hot Wallets

Mobile Wallets

Smartphone applications for on-the-go cryptocurrency management:

- Trust Wallet: Multi-chain mobile wallet with dApp browser

- MetaMask Mobile: Ethereum-focused with extensive DeFi integration

- Coinbase Wallet: User-friendly with educational resources

- Phantom: Solana ecosystem specialist

- Keplr Mobile: Cosmos ecosystem integration

Browser Extension Wallets

Desktop browser plugins for web-based cryptocurrency interactions:

- MetaMask: Industry standard for Ethereum and EVM chains

- Phantom: Leading Solana wallet with clean interface

- Keplr: Cosmos ecosystem gateway

- Rabby: Multi-chain wallet with advanced features

Desktop Wallets

Full-featured applications installed on computers:

- Exodus: Multi-currency wallet with built-in exchange

- Atomic Wallet: Decentralized wallet with staking features

- Electrum: Bitcoin-focused with advanced features

Hot Wallet Advantages

Instant Access

Hot wallets provide immediate access to funds for trading, DeFi interactions, and daily transactions without physical device requirements.

DeFi Integration

Seamless connection to decentralised exchanges, lending protocols, and yield farming opportunities through built-in dApp browsers.

User-Friendly

Intuitive interfaces make cryptocurrency accessible to beginners, with features like QR code scanning and address book management.

Multi-Chain Support

Modern hot wallets support multiple blockchain networks, allowing users to manage diverse cryptocurrency portfolios from a single application.

Regular Updates

Automatic updates ensure compatibility with new protocols and security patches without user intervention.

Hot Wallet Disadvantages

Security Vulnerabilities

Internet connectivity exposes hot wallets to various attack vectors:

- Malware and keyloggers

- Phishing websites and fake applications

- Browser vulnerabilities and extensions

- Mobile device compromises

- Man-in-the-middle attacks

Platform Dependency

Reliance on third-party platforms creates risks from poor security practices, data breaches, or service discontinuation.

Temptation to Overtrade

Easy access can lead to impulsive trading decisions and increased exposure to market volatility.

Comprehensive Feature Comparison

Security Comparison

| Security Aspect | Cold Wallets | Hot Wallets |

|---|---|---|

| Private Key Storage | Offline, hardware-protected | Online, software-protected |

| Internet Exposure | Never connected | Always connected |

| Malware Resistance | Immune | Vulnerable |

| Phishing Protection | High (device verification) | Low (user dependent) |

| Physical Security | Required | Device dependent |

| Recovery Options | Seed phrase backup | Varies by wallet |

Usability Comparison

| Usability Factor | Cold Wallets | Hot Wallets |

|---|---|---|

| Transaction Speed | Slow (manual confirmation) | Fast (instant) |

| DeFi Access | Limited (requires connection) | Native integration |

| Mobile Access | Limited | Full featured |

| Setup Complexity | Moderate to high | Low to moderate |

| Cost | $50-200 initial | Free |

| Portability | Physical device required | Available anywhere |

Security Best Practices

Cold Wallet Security

- Purchase from Official Sources: Only buy hardware wallets directly from manufacturers

- Verify Authenticity: Check for tamper-evident seals and authenticity certificates

- Secure Seed Phrase Storage: Write down recovery phrases on paper, store in multiple secure locations

- Regular Firmware Updates: Keep device firmware updated for latest security patches

- Test Recovery Process: Verify seed phrase recovery works before storing large amounts

- Physical Security: Store devices in secure locations, consider safety deposit boxes

Hot Wallet Security

- Use Reputable Wallets: Choose well-established wallets with strong security track records

- Enable All Security Features: Use biometric locks, PINs, and two-factor authentication

- Regular Updates: Keep wallet applications and operating systems updated

- Verify URLs: Always double-check website URLs and app store listings

- Limit Stored Amounts: Keep only small amounts needed for regular transactions

- Backup Seed Phrases: Securely store recovery phrases offline

Practical Use Case Scenarios

Long-Term Investment (Cold Wallet Recommended)

Scenario: You've accumulated 2 BTC and 50 ETH over several years and plan to hold for the next decade.

Solution: Store 90% in a Ledger Nano X with seed phrase backed up in multiple secure locations. Keep 10% in a hot wallet for potential opportunities.

Active DeFi Participation (Hot Wallet Required)

Scenario: You actively provide liquidity to Uniswap pools and participate in yield farming across multiple protocols.

Solution: Use MetaMask for primary DeFi interactions, connected to a hardware wallet for transaction signing when possible.

Daily Cryptocurrency Usage (Hot Wallet Preferred)

Scenario: You regularly pay for goods and services with cryptocurrency and trade frequently.

Solution: Mobile wallet like Trust Wallet for daily transactions, with larger holdings secured in cold storage.

Institutional Holdings (Cold Wallet Essential)

Scenario: Managing cryptocurrency treasury for a company or investment fund.

Solution: Multi-signature cold storage setup with hardware wallets distributed among key stakeholders.

Hybrid Storage Strategies

The 80-20 Rule

Store 80% of holdings in cold storage for security, keep 20% in hot wallets for accessibility and opportunities. This balance provides security while maintaining flexibility.

Tiered Security Approach

- Tier 1 (Cold Storage): Long-term holdings, emergency funds

- Tier 2 (Hardware + Hot): Medium-term investments, DeFi positions

- Tier 3 (Hot Wallet): Daily spending, trading funds

Activity-Based Allocation

- HODLing: 95% cold, 5% hot

- Moderate Trading: 70% cold, 30% hot

- Active DeFi: 50% cold, 50% hot

- Day Trading: 20% cold, 80% hot

How to Choose the Right Wallet

Assessment Questions

- How much cryptocurrency do you own?

- Under $1,000: Hot wallet acceptable

- $1,000-$10,000: Consider cold storage

- Over $10,000: Cold storage essential

- How often do you transact?

- Rarely: Cold wallet preferred

- Weekly: Hybrid approach

- Daily: Hot wallet primary

- What's your technical expertise?

- Beginner: Start with a reputable hot wallet

- Intermediate: Hybrid approach

- Advanced: Custom security setup

- Do you use DeFi protocols?

- Never: Cold storage sufficient

- Occasionally: Hardware wallet + hot wallet

- Frequently: Hot wallet with hardware signing

Final Recommendations

For Beginners

Start Simple: Begin with a reputable hot wallet like Coinbase Wallet or Trust Wallet. Learn the basics of cryptocurrency management before investing in hardware wallets.

For Intermediate Users

Hybrid Approach: Use a hardware wallet (Ledger Nano X or Trezor Model T) for long-term storage, maintain a hot wallet for regular transactions and DeFi activities.

For Advanced Users

Multi-Layered Security: Implement tiered storage with multiple hardware wallets, multi-signature setups, and specialised hot wallets for different activities.

For Institutions

Enterprise Solutions: Use institutional custody services combined with multi-signature cold storage and comprehensive security policies.

Universal Principles

- Never store more than you can afford to lose in hot wallets

- Always backup seed phrases securely

- Regularly review and update security practices

- Stay informed about new threats and solutions

- Test recovery procedures before storing large amounts

When to Use Each Wallet Type

Use Cold Wallets When:

- Storing significant amounts of cryptocurrency (>$10,000)

- Planning long-term investment strategies

- Prioritizing maximum security over convenience

- Managing institutional or business cryptocurrency holdings

- Creating inheritance or estate planning arrangements

- Operating in high-risk environments or jurisdictions

Use Hot Wallets When:

- Making frequent transactions or trades

- Participating in DeFi protocols and yield farming

- Using cryptocurrency for daily payments

- Learning cryptocurrency basics with small amounts

- Needing immediate access to funds

- Interacting with new protocols or applications

Use Both When:

- Building a comprehensive cryptocurrency strategy

- Balancing security with accessibility needs

- Managing diverse cryptocurrency activities

- Optimising for both long-term growth and short-term opportunities

- Implementing proper risk management practices

Cost Analysis: Cold vs Hot Wallets

Initial Setup Costs

| Wallet Type | Hardware Cost | Setup Time | Learning Curve | Ongoing Costs |

|---|---|---|---|---|

| Cold Wallets | $50-200 | 1-2 hours | Moderate-High | Firmware updates (free) |

| Hot Wallets | Free | 15-30 minutes | Low-Moderate | Transaction fees only |

Long-Term Value Proposition

While cold wallets require upfront investment, they provide significant long-term value:

- Security ROI: Prevents potential losses from hacks or theft

- Peace of Mind: Reduces stress and anxiety about fund security

- Insurance Value: Some insurance policies require hardware wallet usage

- Resale Value: Hardware wallets retain value and can be resold

- Multi-Asset Support: One device supports thousands of cryptocurrencies

Enterprise and Institutional Considerations

Corporate Wallet Strategies

Businesses and institutions have unique requirements for cryptocurrency storage:

Multi-Signature Cold Storage

- Governance Structure: Require multiple executives to authorize transactions

- Geographic Distribution: Store signing devices in different locations

- Succession Planning: Ensure business continuity if key personnel leave

- Audit Compliance: Maintain detailed records for regulatory compliance

Operational Hot Wallets

- Daily Operations: Small amounts for regular business transactions

- API Integration: Automated payments and treasury management

- Employee Access: Controlled access for authorized personnel

- Real-Time Monitoring: 24/7 monitoring and alert systems

Regulatory Compliance

Different jurisdictions have varying requirements for cryptocurrency custody:

- United States: CFTC and SEC guidance on custody requirements

- European Union: MiCA regulations for crypto asset service providers

- United Kingdom: FCA rules for authorized crypto businesses

- Asia-Pacific: Varying national regulations and licensing requirements

Emerging Wallet Technologies

Next-Generation Cold Storage

Innovation continues in cold storage technology:

- Biometric Authentication: Fingerprint and facial recognition integration

- Quantum-Resistant Encryption: Preparation for quantum computing threats

- Air-Gapped Smartphones: Dedicated devices that never connect to internet

- Distributed Key Storage: Splitting keys across multiple secure locations

- Smart Card Integration: Banking-grade security in credit card form factor

Advanced Hot Wallet Features

Hot wallets are becoming more sophisticated:

- AI-Powered Security: Machine learning for fraud detection

- Social Recovery: Trusted contacts can help recover lost access

- Programmable Wallets: Smart contract-based wallet logic

- Cross-Chain Bridges: Seamless asset transfers between networks

- Integrated DeFi: Native yield farming and staking features

Hybrid Solutions

The future may belong to hybrid approaches:

- Smart Cold Storage: Hardware wallets with limited connectivity

- Threshold Signatures: Combining multiple security methods

- Time-Locked Transactions: Delayed execution for security

- Conditional Access: Context-aware security policies

Recommended Wallets by Category

Best Cold Wallets

- Ledger Nano X - Premium hardware wallet with mobile support

- Trezor Model T - Open-source with touchscreen interface

- Tangem Wallet - Card-based NFC hardware wallet

Best Hot Wallets

- MetaMask - Industry standard for Ethereum and DeFi

- Trust Wallet - Multi-chain mobile wallet

- Phantom - Leading Solana ecosystem wallet

Hybrid Solutions

- MetaMask + Ledger: Best of both worlds for Ethereum users

- Keplr + Ledger: Secure Cosmos ecosystem participation

- Gnosis Safe: Multi-signature smart contract wallet

- Casa: Collaborative custody with recovery options