Best Passive Income Strategies in Crypto (2025)

A practical guide to staking, lending, DeFi yields, CeFi earn, liquidity strategies, and crypto cards — with risk, effort and return trade-offs.

Overview

Passive income in cryptocurrency has evolved dramatically in 2025, offering investors multiple pathways to generate returns without active trading. From traditional staking and lending to sophisticated DeFi yield strategies, the landscape provides opportunities for every risk profile and investment size.

The key to successful crypto passive income lies in understanding the risk-return spectrum and diversifying across multiple strategies. While some methods, such as CeFi earn programs, offer simplicity and predictable returns, others, like yield farming, can provide higher yields but require more active management and carry additional risks.

In 2025, we're seeing increased institutional adoption, better regulatory clarity, and more mature protocols, making passive crypto income more accessible and reliable than ever before. However, the fundamental principle remains: higher returns typically come with higher risks, and proper due diligence is essential.

Market Context for 2025

The crypto passive income landscape in 2025 is characterised by:

- Regulatory Clarity: Clearer guidelines in major jurisdictions have increased institutional participation

- Protocol Maturity: Battle-tested DeFi protocols with proven track records

- Yield Compression: More competition has led to more sustainable, realistic yield expectations

- Risk Management: Better tools and practices for managing smart contract and counterparty risks

- Accessibility: Improved user interfaces making DeFi accessible to mainstream users

Comprehensive Strategy Breakdown

1. Proof-of-Stake (PoS) Staking

Staking remains one of the most straightforward passive income methods in crypto. By locking up tokens in a PoS network, you help secure the blockchain and earn rewards in return.

Native Staking

Direct staking involves running your own validator node or delegating to existing validators. Popular networks include:

- Ethereum (ETH): 3.2-4.1% APY, 32 ETH minimum for solo staking

- Cardano (ADA): 4.5-5.2% APY, no minimum, no lock-up period

- Solana (SOL): 6.8-7.5% APY, flexible delegation options

- Polkadot (DOT): 10-14% APY, 28-day unbonding period

Liquid Staking Solutions

Liquid staking protocols like Lido and Rocket Pool allow you to stake ETH while maintaining liquidity through derivative tokens (stETH, rETH). This innovation has revolutionised staking by eliminating the opportunity cost of locked funds.

Benefits: Maintain liquidity, compound rewards, participate in DeFi

Risks: Smart contract risk, slashing risk, derivative token depeg risk

Restaking (EigenLayer)

The newest evolution in staking, restaking, allows ETH stakers to secure additional protocols and earn extra rewards. EigenLayer leads this space, offering 15-25% additional APY on top of base ETH staking rewards.

2. Crypto Lending (CeFi & DeFi)

Lending your crypto assets to borrowers generates interest income. The approach differs significantly between centralised (CeFi) and decentralised (DeFi) platforms.

CeFi Lending Platforms

Centralised platforms offer simplicity and often insurance, but require trust in the platform's solvency:

- Nexo: Up to 8% APY on stablecoins, EU regulated, insurance coverage

- YouHodler: Up to 7% APY, Swiss regulated, crypto-backed loans

- BlockFi: Competitive rates but limited availability post-bankruptcy

DeFi Lending Protocols

Decentralised lending removes intermediaries but requires more technical knowledge:

- Aave: 2-8% APY depending on asset, flash loans, safety module

- Compound: Algorithmic interest rates, governance token rewards

- MakerDAO: DAI savings rate, currently 3.3% APY

Key Considerations:

- Collateralization ratios and liquidation risks

- Platform security and audit history

- Interest rate volatility

- Regulatory compliance and insurance coverage

3. Yield Farming and Liquidity Mining

Yield farming involves providing liquidity to DeFi protocols in exchange for trading fees plus token incentives. While potentially lucrative, it requires active management and carries significant risks.

Popular Yield Farming Strategies

- Uniswap V3: Concentrated liquidity positions, 0.05-1% fees plus UNI rewards

- Curve Finance: Stablecoin pools, 2-15% APY, CRV token rewards

- Pendle: Yield trading, 8-25% APY on various assets

- Balancer: Multi-asset pools, BAL token incentives

Understanding Impermanent Loss

Impermanent loss occurs when the price ratio of pooled assets changes. For a 50/50 ETH/USDC pool, if ETH doubles in price, you'll have less ETH than if you held it. This loss is "impermanent" because it disappears if prices return to the original ratio.

Mitigation Strategies:

- Choose correlated asset pairs (ETH/stETH)

- Use stablecoin pairs to minimize IL

- Ensure trading fees + rewards exceed potential IL

- Monitor positions regularly and rebalance when needed

→ Complete yield farming guide

4. CeFi Earn Programs

Centralised exchange earn programs offer the simplest entry point for crypto passive income. Major exchanges provide competitive rates with user-friendly interfaces.

Top CeFi Earn Platforms 2025

- Binance Earn: Flexible savings (1-8% APY), locked staking (up to 20% APY)

- Coinbase: 2-5% APY on various assets, FDIC insurance on USD

- Kraken: On-chain staking, 4-20% APY depending on asset

- OKX: Earn products, DeFi integration, competitive rates

Advantages: Simple UX, customer support, often insured

Disadvantages: Counterparty risk, withdrawal limits, KYC requirements

5. Advanced Liquidity Strategies

Sophisticated investors can employ advanced strategies combining multiple DeFi protocols for enhanced yields.

Leveraged Staking

Borrow stablecoins against staked ETH to buy more ETH and stake it, amplifying returns. Platforms like Lido + Aave make this possible:

- Stake ETH on Lido, receive stETH

- Deposit stETH as collateral on Aave

- Borrow USDC against stETH

- Buy more ETH with USDC and repeat

Risk Warning: Leveraged positions can be liquidated if the stETH/ETH ratio drops or if the ETH price falls significantly.

Delta-Neutral Strategies

Earn yield while hedging price exposure by taking equal long and short positions. Popular on Pendle and GMX.

Cross-Chain Yield Optimization

Bridge assets to different chains for higher yields, considering gas costs and bridge risks. Popular chains include Arbitrum, Polygon, and Avalanche.

6. Crypto Cashback and Rewards Cards

Crypto cards offer passive income through everyday spending, providing cashback in cryptocurrency.

Top Crypto Cards 2025

- Wirex: Up to 8% cashback, multiple cryptocurrencies

- Crypto.com Card: Up to 5% cashback, CRO staking requirements

- Coinbase Card: 4% cashback in select cryptos, no annual fee

Considerations: Geographic availability, staking requirements, spending categories

Real-World Case Studies

Case Study 1: Conservative Approach ($10,000 Portfolio)

Profile: Risk-averse investor seeking steady returns

Strategy:

- 40% USDC on Nexo (8% APY) = $4,000 → $320/year

- 30% ETH liquid staking via Lido (3.8% APY) = $3,000 → $114/year

- 20% BTC on Binance Earn (2% APY) = $2,000 → $40/year

- 10% emergency cash = $1,000 → $0/year

Total Annual Return: $474 (4.74% APY)

Risk Level: Low to Medium

Time Commitment: 1-2 hours/month

Case Study 2: Balanced Approach ($25,000 Portfolio)

Profile: Moderate risk tolerance, some DeFi experience

Strategy:

- 25% stETH/ETH Curve pool (5% APY) = $6,250 → $312/year

- 25% USDC lending on Aave (4% APY) = $6,250 → $250/year

- 20% SOL staking (7% APY) = $5,000 → $350/year

- 15% Pendle PT-stETH (12% APY) = $3,750 → $450/year

- 15% stable reserves = $3,750 → $0/year

Total Annual Return: $1,362 (5.45% APY)

Risk Level: Medium

Time Commitment: 3-5 hours/month

Case Study 3: Aggressive Approach ($50,000 Portfolio)

Profile: High risk tolerance, active DeFi participant

Strategy:

- 30% Leveraged stETH strategy (15% APY) = $15,000 → $2,250/year

- 25% High-yield farming rotations (20% APY) = $12,500 → $2,500/year

- 20% Restaking on EigenLayer (18% APY) = $10,000 → $1,800/year

- 15% Arbitrage opportunities (25% APY) = $7,500 → $1,875/year

- 10% Stable reserves = $5,000 → $0/year

Total Annual Return: $8,425 (16.85% APY)

Risk Level: High

Time Commitment: 10-15 hours/month

Key Lessons from Case Studies

- Diversification is crucial: No single strategy should dominate your portfolio

- Risk scales with returns: Higher yields require more active management and carry more risk

- Time commitment matters: Passive strategies require less monitoring but offer lower returns

- Reserve funds are essential: Always maintain liquidity for opportunities and emergencies

Comprehensive Risk Analysis

Smart Contract and Protocol Risks

DeFi protocols are governed by smart contracts that can contain bugs or vulnerabilities. Even audited protocols can have issues:

- Code vulnerabilities: Bugs that can be exploited by attackers

- Governance attacks: Malicious proposals that change protocol parameters

- Oracle manipulation: Price feed attacks affecting lending protocols

- Upgrade risks: Protocol changes that affect user funds

Mitigation: Use battle-tested protocols, check audit reports, diversify across platforms, and start with small amounts.

Counterparty and Custodial Risks

CeFi platforms introduce counterparty risk - the possibility that the platform becomes insolvent or acts maliciously:

- Platform insolvency: FTX, Celsius, and BlockFi collapse in 2022-2023

- Regulatory action: Government intervention affecting operations

- Operational failures: Technical issues, hacks, or mismanagement

- Withdrawal restrictions: Limits during market stress

Mitigation: Choose regulated platforms, check insurance coverage, don't keep all funds on one platform, verify platform solvency regularly.

Market and Liquidity Risks

Crypto markets are volatile, and this affects passive income strategies:

- Price volatility: Asset values can fluctuate dramatically

- Impermanent loss: Affects liquidity providers in AMMs

- Liquidation risk: Leveraged positions can be forcibly closed

- Correlation risk: Crypto assets often move together during market stress

Mitigation: Diversify across asset classes, use stablecoins for yield, avoid excessive leverage, maintain emergency reserves.

Operational and Security Risks

User errors and security breaches are common causes of fund loss:

- Private key loss: Losing access to wallets

- Phishing attacks: Fake websites stealing credentials

- Transaction errors: Sending to wrong addresses

- Device compromise: Malware or hardware failures

Mitigation: Use hardware wallets, verify URLs carefully, double-check transactions, maintain backups, and use multi-signature wallets for large amounts.

Regulatory and Tax Risks

The regulatory landscape for crypto is evolving rapidly:

- Changing regulations: New rules affecting platform operations

- Tax implications: Passive income is typically taxable

- Geographic restrictions: Some platforms may become unavailable

- Reporting requirements: KYC/AML compliance obligations

Mitigation: Stay informed about regulations, maintain detailed records, consult tax professionals, use compliant platforms.

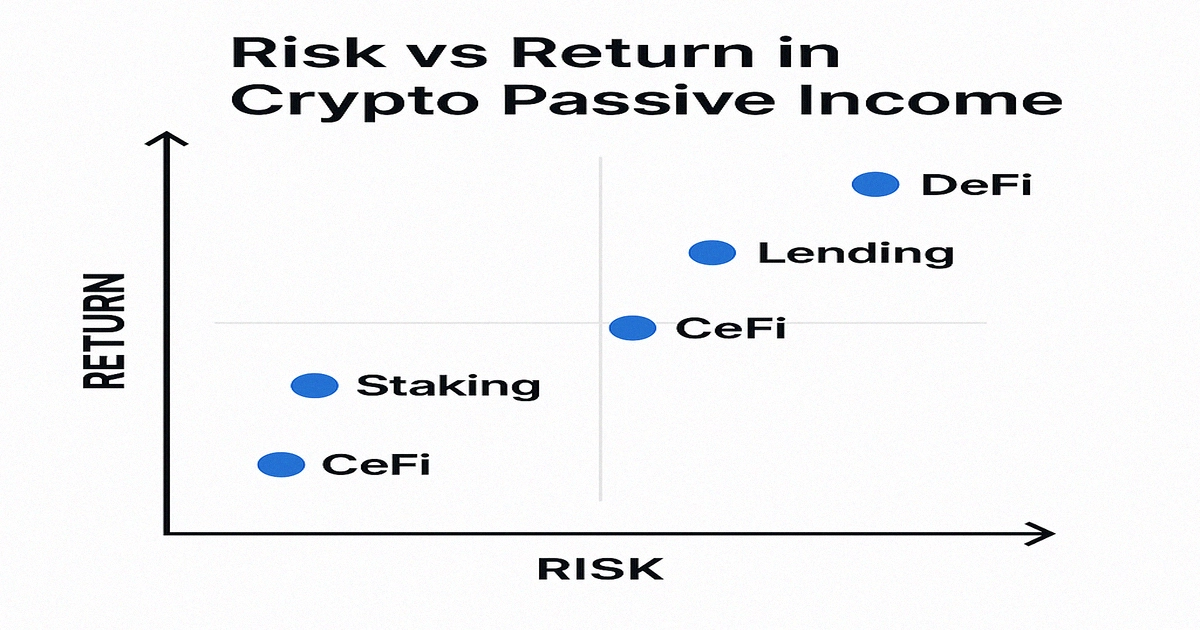

Risk vs Return Chart

Tools & Providers

- CeFi: Binance Earn, Nexo, Coinbase

- DeFi: Lido, Rocket Pool, Aave, Pendle (see best staking platforms compare)

Comparison Table

| Method | Effort | Risk | Return potential | Where to start |

|---|---|---|---|---|

| Staking | Low | Medium | Medium | Lido Review |

| Lending | Low | Medium | Medium | Nexo |

| Yield Farming | Medium | High | High | Yield Farming guide |

| CeFi Earn | Low | Medium | Low–Medium | Binance Earn |

| Liquidity | High | High | High | DeFi vs CeFi analysis |

Frequently Asked Questions

What is the safest passive income method in crypto?

There is no zero-risk method in crypto. However, for many users, staking large-cap assets like ETH or ADA via reputable providers offers a good balance of risk and return. CeFi platforms, such as Nexo or Binance, provide additional simplicity but introduce counterparty risk. The key is diversification and never investing more than you can afford to lose.

Is DeFi yield better than CeFi earnings in 2025?

It depends on your risk tolerance and technical expertise. DeFi typically offers higher yields (8-25% APY) but requires more active management and carries risks associated with smart contracts. CeFi is simpler (2-8% APY) but adds counterparty risk and often has caps on earnings. Many investors use both approaches for diversification.

How much can I realistically earn with $1,000?

With $1,000, you can expect:

- Conservative approach: $30-50/year (3-5% APY) via CeFi staking

- Moderate approach: $50-80/year (5-8% APY) mixing CeFi and simple DeFi

- Aggressive approach: $80-200/year (8-20% APY) with active DeFi strategies

Remember that higher returns come with higher risks and time commitments.

Do I need a lot of money to start?

No, you can start with as little as $50-100. Many platforms have low minimums:

- Binance Earn: $1 minimum

- Lido staking: No minimum

- Aave lending: ~$10 minimum (due to gas costs)

- Most CeFi platforms: $10-50 minimum

How often should I check my positions?

It depends on your strategy:

- CeFi earn/Simple staking: Monthly check is sufficient

- DeFi lending: Weekly monitoring recommended

- Yield farming: Daily to weekly, depending on volatility

- Leveraged strategies: Daily monitoring essential

What about taxes on passive crypto income?

Crypto passive income is generally taxable as ordinary income in most jurisdictions. Key considerations:

- Track all rewards and their USD value when received

- Staking rewards are taxed when received, not when sold

- DeFi yields may have complex tax implications

- Consider using crypto tax software like Koinly or CoinTracker

- Consult a tax professional for large amounts

Should I use a hardware wallet for passive income?

For significant amounts (>$1,000), yes. Hardware wallets like Ledger or Tangem provide better security than software wallets. However, some strategies require keeping funds on platforms or in hot wallets for functionality.

What's the biggest mistake beginners make?

The most common mistakes include:

- Chasing high yields without understanding risks

- Not diversifying across strategies and platforms

- Ignoring gas costs on Ethereum-based strategies

- Poor security practices leading to fund loss

- Not tracking for tax purposes

Practical Implementation Tips

Getting Started Checklist

- Education first: Understand each strategy before investing

- Start small: Begin with 5-10% of your crypto portfolio

- Choose your risk level: Conservative, moderate, or aggressive approach

- Set up proper security: Hardware wallet, 2FA, secure passwords

- Track everything: Use spreadsheets or portfolio trackers

- Plan for taxes: Understand your jurisdiction's requirements

Platform Selection Criteria

When choosing platforms for passive income, evaluate:

- Security track record: No major hacks or fund losses

- Regulatory compliance: Licensed and compliant operations

- Insurance coverage: Protection for user funds

- Transparency: Clear terms, regular audits, proof of reserves

- User experience: Intuitive interface, good customer support

- Yield sustainability: Realistic, not too-good-to-be-true rates

Portfolio Allocation Guidelines

Recommended allocation by risk tolerance:

Conservative Portfolio (Low Risk)

- 50% Stablecoins on regulated CeFi platforms

- 30% Large-cap staking (ETH, ADA, SOL)

- 15% Liquid staking derivatives

- 5% Cash reserves

Moderate Portfolio (Medium Risk)

- 30% CeFi earn programs

- 25% DeFi lending (Aave, Compound)

- 20% Liquid staking

- 15% Conservative yield farming

- 10% Cash reserves

Aggressive Portfolio (High Risk)

- 20% Leveraged staking strategies

- 25% High-yield farming

- 20% Restaking protocols

- 15% Arbitrage opportunities

- 10% Experimental protocols

- 10% Cash reserves

Monitoring and Rebalancing

Successful passive income requires periodic review:

- Weekly: Check for any protocol issues or news

- Monthly: Review yields and compare alternatives

- Quarterly: Rebalance portfolio based on performance

- Annually: Comprehensive strategy review and tax planning

Red Flags to Avoid

Warning signs of potentially risky opportunities:

- Unsustainable yields: >50% APY without clear value creation

- Anonymous teams: No known developers or advisors

- No audits: Unaudited smart contracts

- Ponzi mechanics: Returns paid from new investor funds

- Pressure tactics: Limited-time offers, FOMO marketing

- Lack of transparency: Unclear how yields are generated